HSA and FSA Over-Contributions

This article will explain how to audit and address HSA/FSA over-contributions, as well as offer tips on how to avoid potential over-contributions in the first place.

Addressing HSA Over-Contributions

Auditing the Data

The first step to addressing an HSA over-contribution is to audit the data.

-

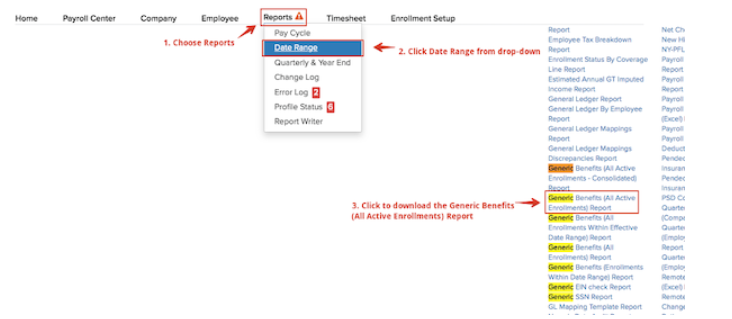

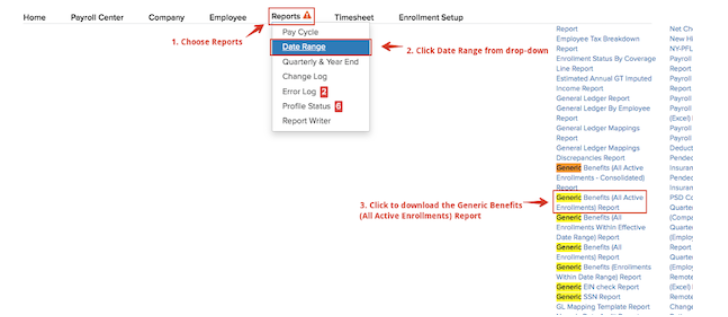

Pull a Generic Benefits (All Active Enrollments) Report to start off. This will provide employees’ annual election information and can be found in Namely Payroll > Reports > Date Range:

-

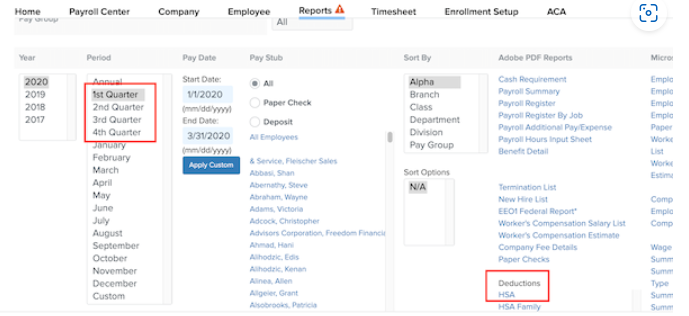

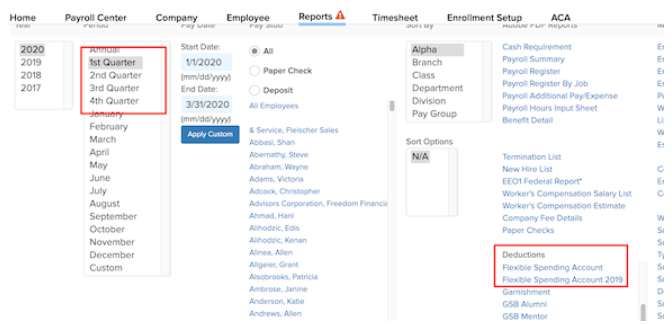

Next, from the same screen, pull Deduction reports for HSA (and/or HSA Family) for each quarter so far in the current year. These reports will give you a snapshot of the HSA contributions the employee has actually made via payroll. Combine the amounts from these quarterly files for YTD totals.

Once you have both reports and have combined the quarterly data in the Deduction reports, you will be able to use the YTDs and identify any employees who have over-contributed. Once you identify any employee in this situation, there are two approaches to remedy:

-

You or your carrier may choose to allow employees to change their annual election (as long as it does not exceed the maximum) to match their current YTD contributions. If this is the case, reimbursements (see below) would only be needed for employees that contributed over the IRS annual maximum (which would equal the difference of their YTD total minus the IRS annual maximum).

-

Compare current YTD totals to employees’ original plan volume elected (using the Generic Benefits Report); employees can be refunded the difference between their current YTD contribution and their plan volume (or IRS maximum, if that’s what was elected).

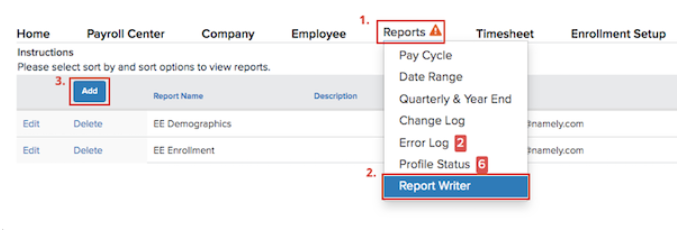

Note: if you would also like to see a report to validate active employee deduction amounts, you can pull a Deductions Report via the Namely Payroll > Reports > Report Writer. (If there is already a Deductions Report in your Report Writer, you can simply make sure it's set to pull all employees and click Run.)

Reimbursements

You are responsible for processing reimbursements for employees, which is usually with your next regularly scheduled payroll. If you need assistance or have questions about the process, please reach out to the Service team via the Help Community- please include any details from your investigation, including affected employees, over-contribution amounts, etc.

Tax Implications

HSA is reported on the W-2 and impacts taxable wages if the employee’s portion of HSA was incorrect. If it is the employee’s portion that is affected here, please submit a case in the Help Community alerting Namely to any discrepancies, and our Tax Team will take the proper steps to have W-2Cs and amendments completed, if necessary.

Addressing FSA Over-Contributions

Auditing the Data

The first step to addressing an FSA over-contribution is to audit the data.

-

Pull a Generic Benefits (All Active Enrollments) Report to start off. This will provide employees’ annual election information and can be found in Namely Payroll > Reports > Date Range:

-

Next, from the same screen, pull Deduction reports for FSA for each quarter so far in the current year. These reports will give you a snapshot of the FSA contributions the employee has actually made via payroll. Combine the amounts from these quarterly files for YTD totals.

Once you have both reports and have combined the quarterly data in the Deduction reports, you will be able to use the YTDs and identify any employees who have over-contributed.

Unlike with an HSA, FSA annual volume elections cannot be changed unless the employee is eligible for a Qualifying Life Event (QLE). This means that the only option is to compare current YTD totals to employees’ original plan volume elected (in addition to the IRS annual maximum), then refund affected employees with the difference between their current YTD contribution and their plan volume elected.

Reimbursements

You are responsible for processing reimbursements for employees, which is usually with your next regularly scheduled payroll. If you need assistance or have questions about the process, please reach out to the Service team via the Help Community- please include any details from your investigation, including affected employees, over-contribution amounts, etc.

Tax Implications

HSA is reported on the W-2 and impacts taxable wages if the employee’s portion of HSA was incorrect. If it is the employee’s portion that is affected here, please submit a case in the Help Community alerting Namely to any discrepancies, and our Tax Team will take the proper steps to have W-2Cs and amendments completed, if necessary.

Common Causes of and Prevention Tips for HSA/FSA Over-Contributions

Common causes for an over-contribution include, but are not limited to:

-

Missing pay cycles during client’s plan year, which causes the Benefit Wizard to miscalculate per pay period deductions.

-

Manual changes to plans/deductions.

-

Plan anniversaries that aren’t on the calendar year, which causes Namely Payroll to not be able to cap the amount during the middle of the year.

Many times, over-contributions can be prevented with proper testing of the Benefit Wizard. Be sure to thoroughly test and check pay period calculations for these benefits.

For an additional guard against over-contributions, Namely also recommends a regular deductions/contributions audit (using the process outlined above), especially when the plan year is not on the calendar year. It’s best to audit before processing your last payroll of the plan year.